It's getting more difficult for low-income students to climb the economic ladder as the college graduation gap between the rich and poor grows. While more students from all backgrounds are finishing college, the difference in graduation rates between the top and bottom income groups has widened by nearly 50% over two decades. Also nowadays, education is the most important thing of upward mobility, which means that it’s even more harder for low-income(poor)people to prosper. As follow the some survey, it is recorded that only 9 percent low-income people get college diplomas. From this survey, wealthy made great gains in graduation rates. Why children from low-income backgrounds don't make it through college? One reason from researchers that poor people usually go to lower tier school. Another reason is that their parents don't have the financial means to aid their children. People said that this is a kind of important problem, because poor people usually does not persist to graduation and this is hard for them to find future. In addition, this would cause to them to discourage and drop out. Today, A lot of better paying jobs require more education and skills that employees can only get in college. This can be problem for policy makers, because they should make programs to promote and protect for poor people to attend and complete college. This includes expanding tuition assistance for poorer children to give them a better shot at future financial security.

It's getting more difficult for low-income students to climb the economic ladder as the college graduation gap between the rich and poor grows. While more students from all backgrounds are finishing college, the difference in graduation rates between the top and bottom income groups has widened by nearly 50% over two decades. Also nowadays, education is the most important thing of upward mobility, which means that it’s even more harder for low-income(poor)people to prosper. As follow the some survey, it is recorded that only 9 percent low-income people get college diplomas. From this survey, wealthy made great gains in graduation rates. Why children from low-income backgrounds don't make it through college? One reason from researchers that poor people usually go to lower tier school. Another reason is that their parents don't have the financial means to aid their children. People said that this is a kind of important problem, because poor people usually does not persist to graduation and this is hard for them to find future. In addition, this would cause to them to discourage and drop out. Today, A lot of better paying jobs require more education and skills that employees can only get in college. This can be problem for policy makers, because they should make programs to promote and protect for poor people to attend and complete college. This includes expanding tuition assistance for poorer children to give them a better shot at future financial security.Monday, November 21, 2011

College graduation rates: Income really matters

It's getting more difficult for low-income students to climb the economic ladder as the college graduation gap between the rich and poor grows. While more students from all backgrounds are finishing college, the difference in graduation rates between the top and bottom income groups has widened by nearly 50% over two decades. Also nowadays, education is the most important thing of upward mobility, which means that it’s even more harder for low-income(poor)people to prosper. As follow the some survey, it is recorded that only 9 percent low-income people get college diplomas. From this survey, wealthy made great gains in graduation rates. Why children from low-income backgrounds don't make it through college? One reason from researchers that poor people usually go to lower tier school. Another reason is that their parents don't have the financial means to aid their children. People said that this is a kind of important problem, because poor people usually does not persist to graduation and this is hard for them to find future. In addition, this would cause to them to discourage and drop out. Today, A lot of better paying jobs require more education and skills that employees can only get in college. This can be problem for policy makers, because they should make programs to promote and protect for poor people to attend and complete college. This includes expanding tuition assistance for poorer children to give them a better shot at future financial security.

It's getting more difficult for low-income students to climb the economic ladder as the college graduation gap between the rich and poor grows. While more students from all backgrounds are finishing college, the difference in graduation rates between the top and bottom income groups has widened by nearly 50% over two decades. Also nowadays, education is the most important thing of upward mobility, which means that it’s even more harder for low-income(poor)people to prosper. As follow the some survey, it is recorded that only 9 percent low-income people get college diplomas. From this survey, wealthy made great gains in graduation rates. Why children from low-income backgrounds don't make it through college? One reason from researchers that poor people usually go to lower tier school. Another reason is that their parents don't have the financial means to aid their children. People said that this is a kind of important problem, because poor people usually does not persist to graduation and this is hard for them to find future. In addition, this would cause to them to discourage and drop out. Today, A lot of better paying jobs require more education and skills that employees can only get in college. This can be problem for policy makers, because they should make programs to promote and protect for poor people to attend and complete college. This includes expanding tuition assistance for poorer children to give them a better shot at future financial security.Thursday, November 17, 2011

United States of Hunger

According to recent study United States spending on food stamps had skyrocketed since the recession began. For last year, more than one in families received food stamps, with some states .having significantly higher participation rates. Oregon is the highest rate in the nation that 17.8 percent of families received food stamps, known as Supplemental Nutrition Assistance Program (SNAP) benefits. Tennessee and Michigan follow Oregon as the next highest rates. Is there any relationship between food stamps rate and unemployment rate? In California, their food stamp take-up rate, for example, to be much higher, since its unemployment rate is 11.9 percent, the state is broke, and so many cities there suffered from housing busts. The graph that showing the relationship between median household income and food stamp take-up rates, and the relationship is relatively weak. In addition, the relationship between unemployment rates and food stamp take-up rates is represented as even weaker. There are a lot of variables not at all reflected by unemployment and median income figures, such as inequality and state safety net programs.

According to recent study United States spending on food stamps had skyrocketed since the recession began. For last year, more than one in families received food stamps, with some states .having significantly higher participation rates. Oregon is the highest rate in the nation that 17.8 percent of families received food stamps, known as Supplemental Nutrition Assistance Program (SNAP) benefits. Tennessee and Michigan follow Oregon as the next highest rates. Is there any relationship between food stamps rate and unemployment rate? In California, their food stamp take-up rate, for example, to be much higher, since its unemployment rate is 11.9 percent, the state is broke, and so many cities there suffered from housing busts. The graph that showing the relationship between median household income and food stamp take-up rates, and the relationship is relatively weak. In addition, the relationship between unemployment rates and food stamp take-up rates is represented as even weaker. There are a lot of variables not at all reflected by unemployment and median income figures, such as inequality and state safety net programs.Elasticity - Should We Raise the Price?

Elasticity is a measure of responsiveness. The price elasticity of demand measures the rate of response of quantity demanded due to a price change.

-Example of price elasticity of demand

-Example of price elasticity of demand

A toy factory lowers the price of robot toys from $10 to $9 and finds that weekly quantity demanded of the robot toys goes up from 50 per week to 67.

- Percentage changes in price

: 1/10 x 100 = 10%

- Percentage changes in quantity demanded

: 17/50 x 100 = 34%

2. Calculate the price elasticity of demand for the robot toys.

- 34%/10% = 3.4 (elastic)

3. Calculate the change in total revenue that the robot toys will experience following the fall in price.

-Original total revenue: 10*50 = 500

-Change total revenue: 9*67= 603

- Increase 103 total revenue

4.Draw a “revenue box” diagram to illustrate the effect on quantity demanded and total revenue following the price change for the robot toys.

4.Draw a “revenue box” diagram to illustrate the effect on quantity demanded and total revenue following the price change for the robot toys.- Left picture

5. Was a factory sensible to lower the price of the robot toys? Explain your answer.

- Yes, because the toy factory can increase more total revenue in lower price than higher price.

Saturday, November 12, 2011

Supply and Demand in the Stock Market

A stock is partial ownership of a business or company. As always, there is a risk in trading stocks and shares. People have to consider many factors when they purchase a stock, especially the financial structure of companies. So people would buy a stock that bring a lot of profits and this factor makes a stock more valuable and also makes people inspire to buy. The prices of stocks are determined by supply and demand in the stock market.

A stock has a limited quantity same as other market products. It means that they have a number that the amount of what they bring out and also has a number that distribute in the market. If the supply of a stock increased, the value of the stock falls down so the price goes down. However if the supply drops, the price goes up. For demand, if the stock becomes more popular and everyone wants to buy it, the price increased. If demand goes down, the price falls.

Monday, November 7, 2011

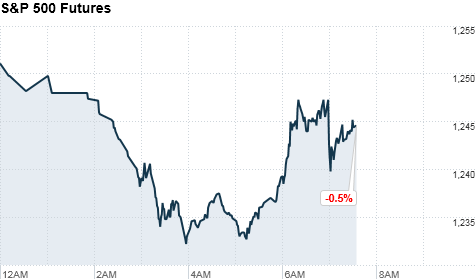

Stocks set for modest losses

Stocks of U.S were falling down, as worries about the stability of Greece and Italy continued to hang over global markets. Some of stocks had dropped continually. Investors remain wary about the European debt crisis, after the Group of 20 summits in Cannes, France last week failed to produce any tangible new solutions. Some of trader said that all is still not well in Europe and it is not going to be better for a while. In addition, they reported that there's a lot more work to be done, so this could drag on a lot further. Greek Prime Minister George Papandreou secured a deal to approve a bailout package during last week's meeting of global leaders, but talks yielded limited details. And while Greece has been the center of focus, investors are now turning their attention to the domino effect Greece's problems are likely to have on Italy. Greece is shifting slightly to the backburner and the focus is on Italy, with 10-year yields on Italian bonds rising to new highs. The dollar rose against the euro, but fell versus the British pound and the Japanese yen. People would invest fewer stocks than before European debt crisis. Nowadays, perhaps, demand curve shifts to left (decreasing) and also I think price can be decreasing.

Stocks of U.S were falling down, as worries about the stability of Greece and Italy continued to hang over global markets. Some of stocks had dropped continually. Investors remain wary about the European debt crisis, after the Group of 20 summits in Cannes, France last week failed to produce any tangible new solutions. Some of trader said that all is still not well in Europe and it is not going to be better for a while. In addition, they reported that there's a lot more work to be done, so this could drag on a lot further. Greek Prime Minister George Papandreou secured a deal to approve a bailout package during last week's meeting of global leaders, but talks yielded limited details. And while Greece has been the center of focus, investors are now turning their attention to the domino effect Greece's problems are likely to have on Italy. Greece is shifting slightly to the backburner and the focus is on Italy, with 10-year yields on Italian bonds rising to new highs. The dollar rose against the euro, but fell versus the British pound and the Japanese yen. People would invest fewer stocks than before European debt crisis. Nowadays, perhaps, demand curve shifts to left (decreasing) and also I think price can be decreasing.

Subscribe to:

Comments (Atom)